Reviews:

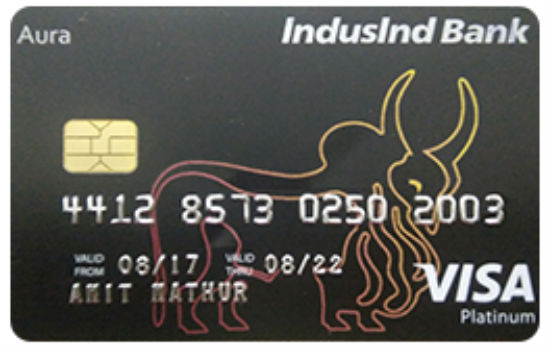

Are you ready to meet a credit card that is rated in the Reward credit cards category and is used frequently in India? Indusind Platinum Aura Credit Card has a system that gives you extra convenience in different spending categories such as EazyDiner Gift Voucher, Vouchagram, Books, Restaurants, Purchase of consumer durables or electronic items. For this reason, people who want to save money in daily life and who want to benefit from discounts thanks to bonus points in larger travel plans can choose Indusind Platinum Aura Credit Card.

Indusind Platinum Aura Credit Card Benefits

Advantages in Shopping

With Indusind Platinum Aura Credit Card you can reshape all your shopping plans. Because Indusind Platinum Aura Credit Card offers you different advantages and opportunities in each expenditure category. In this context, if you do shopping in departmental stores, you will earn 4 saving points every time you spend 150 Rs. In addition, the total saving point rate you can earn annually in this campaign is 1600.

2 Saving Points Per 150 Rs

You will earn 2 saving points each time you spend 150 Rs in the purchase of consumer durables or electronic items category.

1.5 Saving Points per 150 Rs for Restaurants

You’ll earn 1.5 saving points every time you spend 150 Rs on your restaurant bills.

0.5 Saving Points per 150 Rs for Books

In your Book spending, you will earn 1.5 saving points each time you spend 150 Rs. You will earn 0.5 saving points for every 150 Rs in all your spending outside these categories. In this way, you will continue to earn a bonus every time you spend.

Genesis Luxury Vouchers

Within the scope of Genesis Luxury Vouchers, you will have access to a total of 14 different international luxury brands. In this way, you will be able to shop easily.

Pricing and APR

- APR rate is determined as 46% annually

- There is no annual fee

- There is no Joining fee

I want to apply for indusland bank credit card pl contact me

Interest Rate

1

Promotions

0

Services

0

Insurance

0

Bonus

0

I want creadit card