Reviews

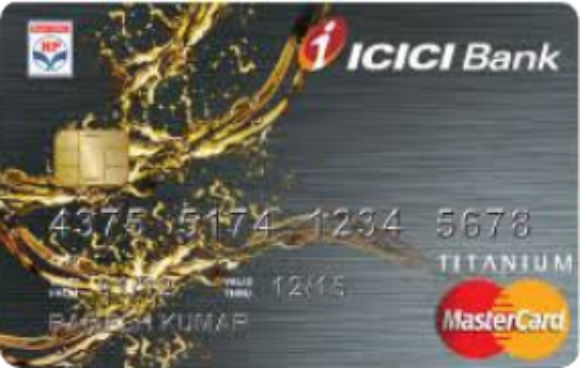

For those who travel often by car, fuel can be a huge expense. Isn’t it a good idea to use a card that will help you with your fuel purchases, make you earn points for these purchases and give you a very high discount on purchases in other categories? ICICI HPCL Platinum Credit Card, designed specifically for fuel expenditures, can be a very good card in terms of reliability, cashback rate and advantages in other expense categories. With this card, you can collect payback points. You can redeem all of the payback points you collect and use them for other fuel purchases.

Benefits and Advantages of ICICI HPCL Credit Card

Extra Security

ICICI HPCL Credit Card has extra security features. The card chip is designed to prevent extra secure and malicious software.

Use Your Points for Gifts and Coupons

Thanks to the Payback system, bonus points that can be loaded onto your credit card can be used for different gifts or coupons. In this way, you will provide convenience in your spending in different categories.

1% Bonus for All Fuel Purchases

You will earn at least a 1 percent bonus for all your fuel purchases from HPCL pumps. These bonuses can sometimes be higher.

Dinner Discounts

Under the Culinary Treats Program, there are 2600 ICICI banks in 12 cities of India, which are contracted with ICICI Bank. You will get a 15 percent discount at all of these restaurants. Therefore, we recommend that you choose these restaurants!

2 Payback Points per Rs 100

Apart from your fuel expenditures, you will earn 2 payback points for each Rs 100 for your retail expenses.

Discounts in Annual Fee

If you spend ₹ 50,000 or more annually, you will have the opportunity to receive discounts on the annual fee. You will benefit from a total discount of Rs 199 and you will save money.

Pricing & APR

- The rate of APR is determined as 40.8% annually

- No joining fee

- The annual fee is 199 Rs – (If you spend 50.000 Rs or more in the previous year, you will not pay this annual fee)