Reviews:

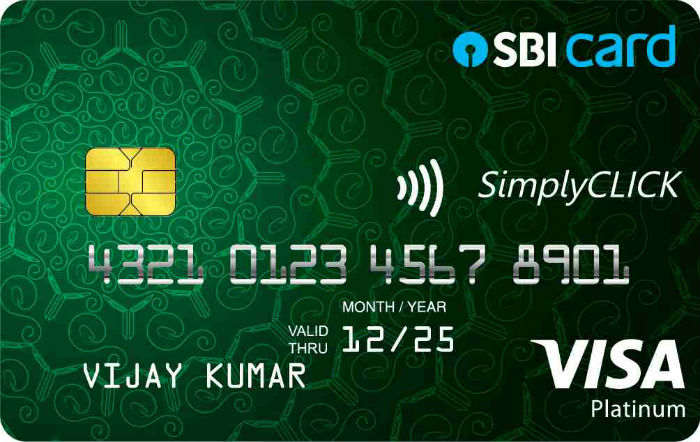

If you are looking for a credit card to save money from your spendings in India then SimplyCLICK SBI credit card may be a great option for you. This amazing card is popular with its reward multipliers in online shopping. In addition to online shopping, you can also earn reward points in your fuel spending and a low amount of reward points in your other purchases. Although the card has an annual fee, you can easily benefit from the annual waiver since the spending threshold is quite reasonable. In every aspect, this is one of the best credit cards that you may want to have and use in India.

Advantages of SimplyCLICK SBI Card

10x Reward Points

You can earn 10x reward points on your online purchases. Amazon, Urbanclap, Cleartrip, Lenskart, and BookMyShow are some of the partner retailers and services.

5x Online Reward Points

You will also earn 5x reward points in your online purchases apart from the above-mentioned organizations.

Possible Annual Waiver

If you spend 100,000 Rupees in a year with your SimplyCLICK SBI credit card, you will not have to pay an annual fee in the following year.

Amazon Gift Card

You are going to receive an Amazon gift card worth of 500 Rupees together with your credit card once your application is approved.

Disadvantages of SimplyCLICK SBI Card

Annual Fee

Just like most of the credit cards in India, SimplyCLICK SBI credit card also charges its holders with an annual fee of 499 Rupees.

No Lounge

Unfortunately, you will be unable to benefit from both domestic and international lounges with this card.

Limited Multipliers

Although the card offers generous reward point multipliers, most of them are designed for online shopping. If you do not shop online a lot then the card will not be beneficial to you at all.