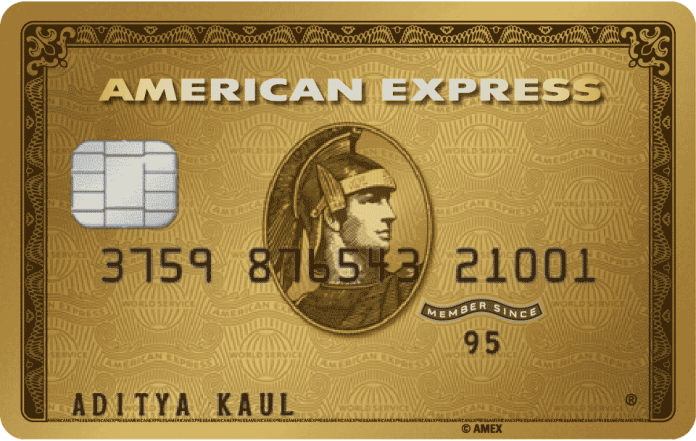

American Express Gold Card Reviews:

American Express is one of the leading credit card issuers in the world as well as in India. Unlike what most Indians believe American Express Gold credit card is not one of those expensive cards. It is perceived as this because of the annual fee of the card. After all, who would like to pay an annual fee when there are many free options? But facts are just the opposite when you consider the benefits and rewards of the card. For instance, you receive 1000 bonus rupees when you make 4 transactions with at least 1000 rupees in a month.

Advantages of American Express Gold Card

No Interest Rate

It can help you to save money by helping you to avoid interest rates since American Express Gold credit card is a charge card that does not have any preset limit in India.

Awesome Customer Service

High-quality customer service and top-tier measurements against fraud transactions.

Discounts on Dining

%20 discounts on partner restaurants and amazing promotions that can help you to save money by earning bonuses depending on your spending.

Plenty of Bonus Points

Only 1000 rupees annual fee in the first year and you can receive 4000 bonus points by using the card 3 times within the first 60 days after issuance to recover the annual fee.

Monthly Rewards

1000 bonus points every month when you spend 6 transactions with at least 1000 Rupees.

Disadvantages of American Express Gold Card

Annual Fee

American Express Gold credit card has an annual fee. The fee is 1000 Rupees for the first year and 4500 Rupees in the following years.

Not Accepted in Offline Stores

It is not accepted in most of the brick and mortar stores but widely accepted in most of the online stores.

No Lounges

You will not be able to use domestic and international lounges in Indian airports.

Charge Card

Since it is a charge card you will have to pay what you have spent in that month. Some users may not like or prefer this option.